TO ALL SITE VISITORS: Glad you found this site. It is however focused mainly on Massachusetts residents. If you are from any of the states, in the list below, please click on the state’s name: California,Colorado, Connecticut, District of Columbia, Idaho, Maryland, Minnesota, New York,Rhode Island, Vermont,Washington. This will take you away from here and redirect where you need to be. Bye! Nice having you visit…)

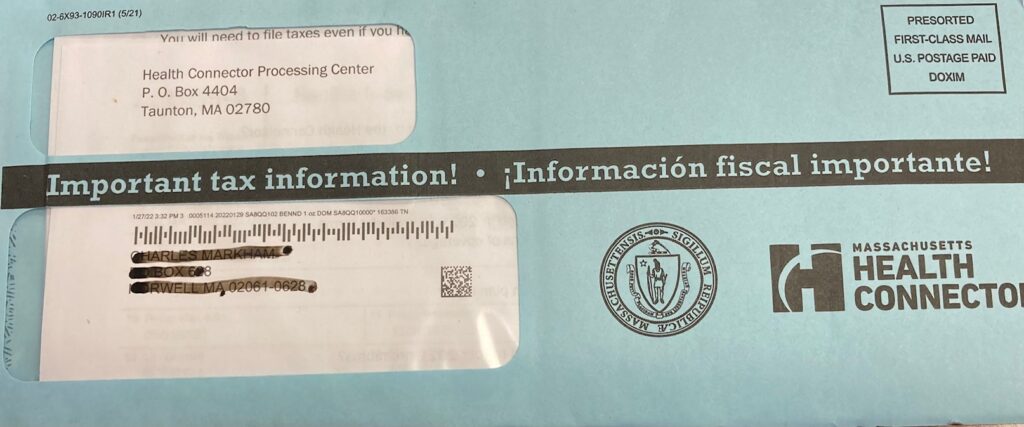

ON JANUARY 31st, 2022, THE MASSACHUSETTS HEALTH CONNECTOR MAILED OUT FORM 1095-A. IT CAME IN AN ENVELOPE THAT IS LIGHT BLUE AND LOOKS LIKE THIS:

If you are from any other state (other than Massachusetts or any of the states above, then you should use Healthcare.gov (or any other state website), log into your account, and look in your “mailbox” for your tax forms.

So, for the lucky MA resident that is looking for their 1095-A. So, if you can’t find that blue envelope, you have found a place that will really tell you what to do….

Here’s how to find IRS Form 1095-A on the Massachusetts Health Connector website. First, you must be able to log into your Mass Health Connector online account. If you don’t have your user name and password. Call the Health Connector at 1-877-623-6765. This information is only for the state of Massachusetts. You can get all your MA Form 1095-A’s going back all years. Other states that use healthcare.gov will find their 1095-A at www.healthcare.gov. Note you may have received IRS letter 12C where the IRS is looking for Form 1095-A.

IF YOU ARE TRYING TO DO THIS FROM YOUR SMART PHONE OR IPAD, PLEASE STOP! Go find a friend or family member with a desktop (Windows or Mac) and do this from there. You are going to need to print out the Form 1095-A. These screen shots are from a computer–NOT YOUR SMART PHONE! I have worked with tons of people and this just does not work on a phone.

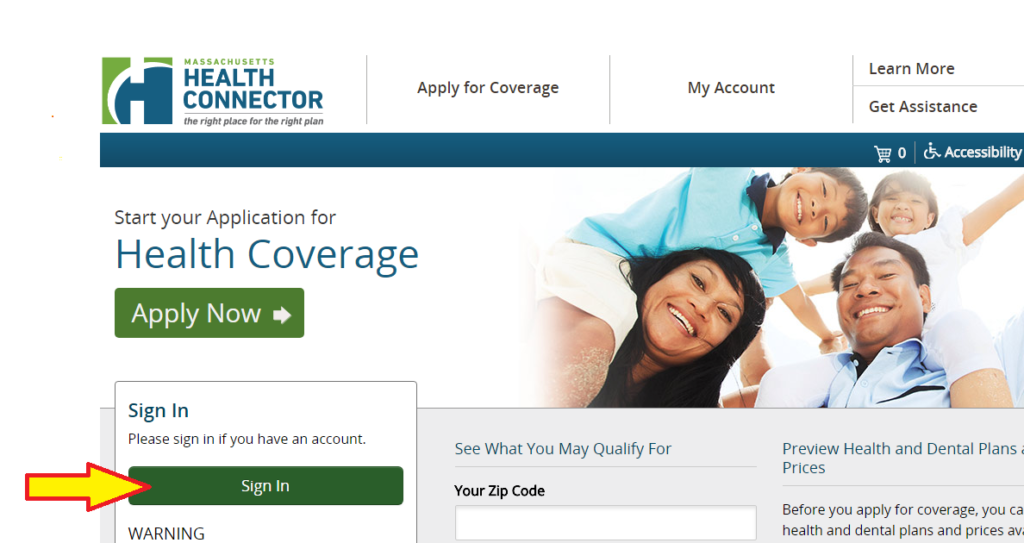

Step 1–Sign into your MA Health Connector Account. You need to be signed in. IF YOU GOT THE IRS LETTER 12C LOOKING FOR FORM 1095-A , THIS MEANS YOU HAVE AN ACCOUNT. FOR SURE. You may need to contact customer service at the Health Connector to figure out your log in and reset your password. The screen may no longer look like what you see below. That’s not important. You just need to log in!

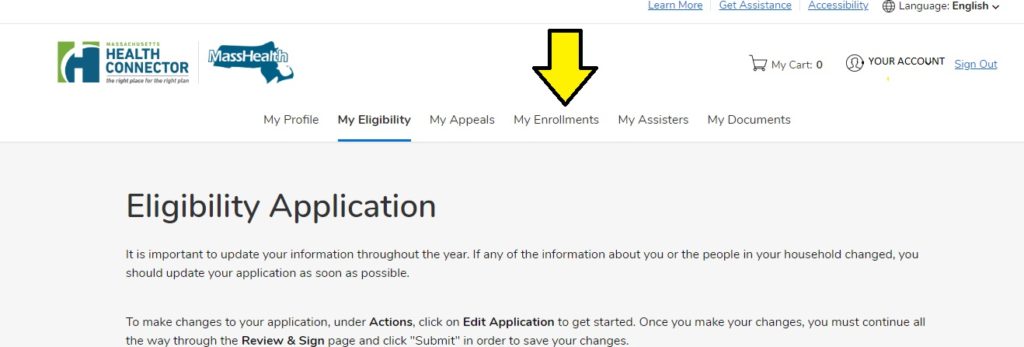

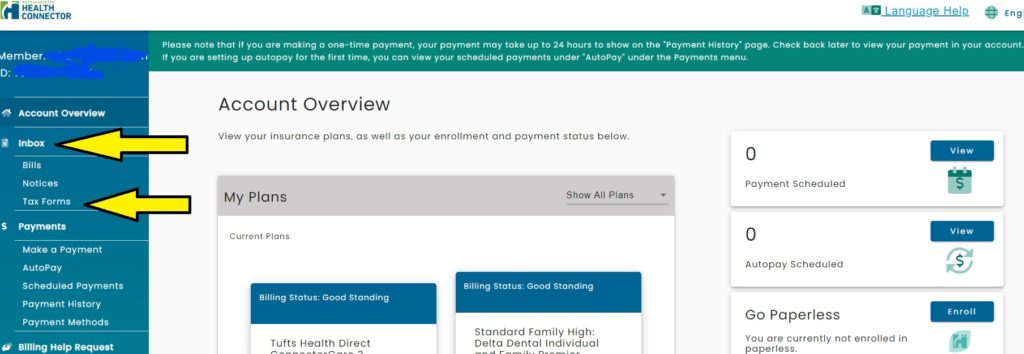

Step 2–This is the next screen you should see, (or at least the top part of it). This is what I see when I log in. Your screen may be different.

Look for the menu across the screen: “My Profile”, “My Eligibility” Etc. Click on “My Enrollments”

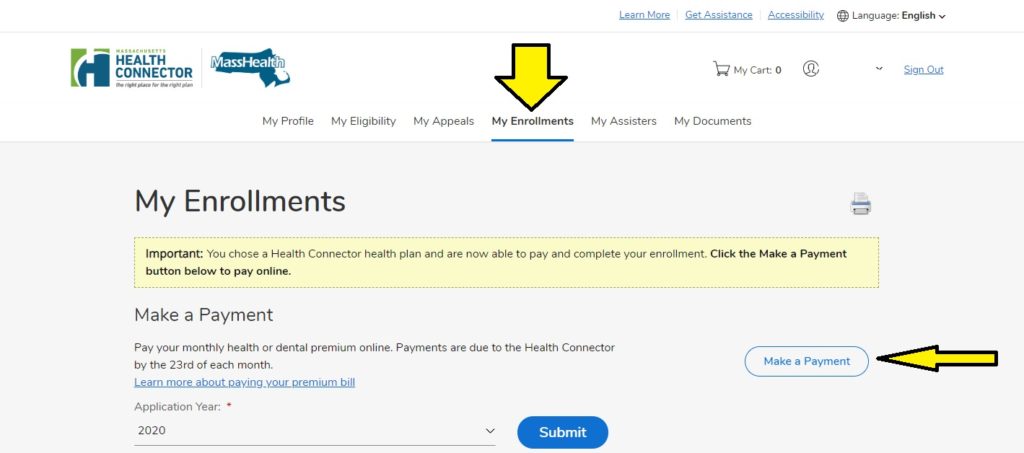

Step 3–This is what I see when I access “My Enrollments”. Look for the button on the right hand side that says “MAKE A PAYMENT”. If for some reason, your interface doesn’t look like mine you want to find the payments section, but you must find payments from WITHIN the application not simply try to make a payment from the website’s home page. Don’t worry, you will not be making a payment. THIS IS IMPORTANT–See to the left where it says “Application Year”. Make sure it does not say “2021”. Change the drop down menu to “2020”. THEN, click “Make a Payment”

Step 4–Once you click on the “Make a Payment” button, you open up a screen that has many more options than simply making payments. NOW, YOU’RE NEARLY DONE. You should be feeling really good. Do you see something that says “IN BOX?”. Underneath, “IN BOX”. you should see “TAX FORMS”. If you don’t see “Tax Forms” click on where it says “IN BOX” and the sub-menu should appear. Obviously, TAX FORMS is what you’ve been looking for all this time. CLICK ON THAT.

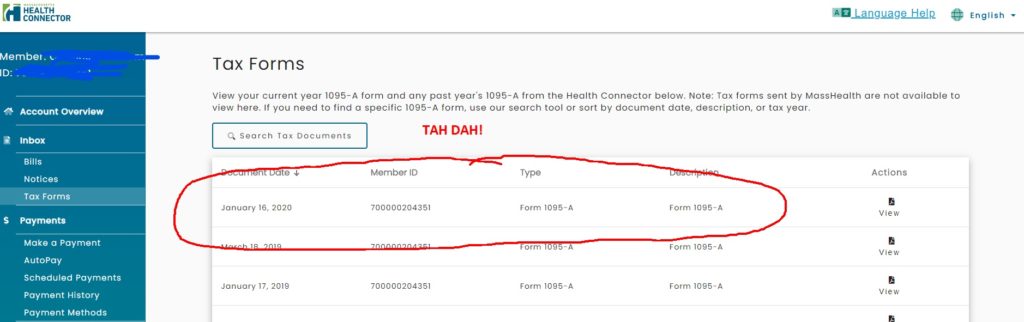

Step 5–Under Notices (also at the top) it says, “My Tax Documents”, click on that:

Step 6–From here, you can print out your Form 1095-A, note that sometimes you may have more than one document for the same year. It just works that way.

ARE YOU STILL HAVING PROBLEMS? Sometimes it still not this easy, and your HealthConnector account just doesn’t look like this. I get it. There’s another option. You can download and printout an Authorized Representative Designation Form here. Print out this form. This form is 3 pages, but you only need to fill out Section 1, Part A–just to the part where you sign. You can designate anyone as your representative. If you designate me (Charles), I will get your Form 1095-A for you from the Health Connector.

Finally, if you have an interesting 1095-A/Premium tax credit situation and need help with your taxes, I am probably better than most in this type of situation, but please, I am full time professional, and while I love helping others in general, this would be “on the meter” as they say. See the rest of my website for information on my practice. My rates are included int eh FAQ section.

FEELING GRATEFUL? Did this information do the trick? Was this just what you were looking for? I am so happy. That’s great. Go on, finish your taxes and have a great day. However, if by some chance you’d like to let me know that you appreciate this web page, then a nice note, or a nominal PayPal contribution of $1.00 (that’s it) would really make my day.

No, I’m not getting rich, but it’s nice to feel appreciated, and it will motivate me to keep doing this type of thing without filling my website with all sorts of ads.

–Charles

(781)

659-6600

(781)

659-6600

Thanks Charles. Your guide helped a lot.

There are good people in this world! Thank you for the helpful article!

This is my first year using the Mass Health Connector site for to obtain my 2022 Health Insurance coverage. I was approved and have made my December 15th 2021 payment for my coverage beginning in January 2022. Should I be receiving a form (possibly a 1095-A) indicating that Medical insurance was paid for in 2021 so that the payment can be listed as a deduction on my 2021 tax year tax filings? Or should the payment be listed as a non-market place payment? I am not sure how to account for the payment as a deduction.

Interesting question, I don’t think your December 2021 payment will affect your 2021 taxes.

Thank you so much for this! i was literally crying trying to find the damn form in my room before thinking to look for it online. THANK YOU.

THANK YOU!!!

You did it! You are the best! I would never find it myself…

thanks for the info!

I kept trying it, and still got the “SAML is required” screen, so I called Health Connector and amazingly got someone right away, and even more amazingly was given the solution!

Just one more step: make sure to select the correct tax year, which is currently 2020, before clicking Make a Payment and then going to Inbox > Tax Forms. (It displays 2021 by default for some reason, and that brings up the error screen.)

I found this page a couple years ago when I was trying to find my tax form for the first time. I NEVER could have found it without your help. Thank you.

I ended up back here today when I was trying to update my autopay information and kept getting an error page saying “SAML is required” every time I clicked the “Make a Payment” button. I tried switching browsers and even tried waiting a few days and trying again, but the problem persisted.

However, I was able to find a workaround! I’m sharing it here in case anyone else is googling ‘MassHealth SAML is required’ like I was and not getting answers. Note: this work around is just for getting into your “Payments” page; unfortunately I still don’t have a workaround for those trying to get their tax forms.

Go to the following URL: https://member.mahealthconnector.org/account/payments/locate-account

Choose either “Find by Exchange ID” or “Find by Social Security Number” and enter the relevant info. Click “FIND MY ACCOUNT.” If one option doesn’t work, try the other. This should allow you to view your payment information and edit it!

Again, this won’t work for finding tax forms, but if anyone is encountering the SAML error when clicking “Make a Payment” under “My Enrollments,” this is the strategy that worked for me.

I did the hours of rage clicking so you don’t have to! Thanks, MassHealth >_<

I was so frustrated until i found this trick, thank you so much for the help

It says SAML is required but i tried different browsers and computers with no luck

Call the Health Connector during the day and select option 2 at the prompt.

I truly never would have found this without your page. Thanks so much!!

My family enrolled directly through mass health, and not through the health connector. We are all under the same plan. The health connector has no information related to our 2020 enrollments, and mass health tells me they do not send out a 1095-A. So how do I get my 1095-A to file my 2020 taxes? I’ve been pushed back and forth with health connector and mass health for hours now and would appreciate any advice. Thank you!

MassHealth does not issue 1095-A forms and you do not need anything to file your taxes.

Thank you SO much for this article and for the comment right here before mine! Found this after 1.5 hours of online aggravation. Need to remember this for next year.

Thank you so much for this – I didn’t get my 1095-A this year and couldn’t find it! I’m very grateful.

Same message in 3 PC SAML is required. What is this?

This is a computer issue. Try different browsers and/or different computers.

I forget how to access this every year and come back to your website. Thank you!

So THANKFUL to have found this information. We moved in 2019 and did not receive this form. After searching for 2 days, I found your info on how to retrieve this form. This was so helpful and saved me another few days of pulling my hair out. Thank you so very much!!!

THANK YOU!!!! That website is ridiculously unintuitive to use. Instructions worked perfectly! You have my deepest thanks!

That was absolutely ridiculous, I never would have found it! Thank you so much

You rock! Thank you so much.

Thank you so much for this information! Literally would NEVER have found it without these instructions… I’m seriously mind blown at how not intuitive it is. They should include these steps in their email!

Awesome TY!

This is great, I’ve been trying to get this done forever now, but could not figure it out. Thank you!

awesome

You are a Godsend. I need this greatly at this time.

Thank you so much for this, the whole thing is so confusing and foolish. You made sense of it all for me. thank you!!

It’s saying saml required for me? What do I do?

This is a problem with your browser. Do not do this from your phone. You need a desktop. If you are

using one browser, like Chrome, try a different one like Internet Explorer. Try Icognito mode in Chrome.

Charles

Hi there!

My taxes have also been help up with no responses back from the IRS . This this week of wanting more information of A1095 and something else. This is the first year I was able to claim my child , as he was born in 2019.

I have no idea why this is happening? But it’s time limited as the letter states. Any information would be helpful. Thank you!

I reached out to you directly to see if I could be of assistnace

I am going crazy. I got a letter saying that my tax return has been held up for months because I need to provide a 1095-a and complete a 8962 with that info.

I can’t find it. Should I go in like I am filling out the application and then wait until the end when I get to the payment part? I need this info for 2019 badly – I can’t get anyone from the IRS on the phone and I can’t find the info they want. So stressed!

I’m so sorry for all this. If you call my office, I can help you. I sent you an email privately.

Help please! My boyfriend and I are on the health connector. When we signed up for insurance they said because we live together and have a child we have to apply together. I received my 1095-A form. Both myself and bf are on here. We both have to do a separated tax return, we aren’t married. I called the health connector and they told me to reach out to a tax professional.

A tax professional told me to call them and ask what to do. Last year they told me to split everything in half but can’t give me a answer this year. What Collum do I split in half? Thank u

You have what is called an “allocated credit” and this is extremely complicated, BUT there is typically a possibility to

optimize this and generate a nice tax result. You need to engage a tax professional at this point. I am happy to help.

The Mass Health Connector website might be one of the worst designed websites I’ve ever encountered. Thank you for making this one ridiculously hidden piece of information very easy to find.

I click on the Make Payment button then I get a message “SAML is required”. Can you tell me what this means

This is some weird technical thing between your computer and the website. I have no idea, but try the

following: If you have more than one browser (Chrome, Firefox, etc.) Try a different browser. If you

are using Chrome, try opening a window in “Incognito Mode”. Finally, a different computer, might work.

I am not an expert and this is the limit of my advice.

Charles,

Very helpful!!!!

Thank you. It is slightly different today than when you wrote it, but the logic still works.

Thank you. I realize that the Health Connector has been revised (early July)

I need to re-do my screenshots. I haven’t had a chance to do anything since 7-15 is upon me.

I am glad that you were able to follow the logic flow. I am actually sorry that they

didn’t fix this to make it easier. That’s what I am inferring from your post.

I tried these helpful steps but it says:

We don’t have any Health Connector plan enrollment information for you yet.

If you completed an application and chose a plan, please allow up to 4 hours to see your plan information here.

If you have not completed an application or chosen a plan yet, please close this screen and return to your online account to take your next step.

If you need help, please visit our website at MAhealthconnector.org. Or call us at 1-877-MA-ENROLL (1-877-623-6765), or TTY 1-877-623-7773

———————————–

this doesn’t make sense because I do have a plan and have had one for years….I do not pay anything monthly so is that the reason? I need to file in 3 days!!! yikes!

THis means you are NOT on Obamacare. If you are not paying anything, you are likely

on MassHealth. There is NO 1095-A and you don’t have any Advanced Premium Tax Credits to

deal with.

THANK YOU so much!!! As you can see I waited till almost the last minute to do my taxes!! And they sure don’t make it easy to find!

Thanks for the help! The health connector is so crappy we need people like you!

Thanks, I had looked around for this form (both physical and online) for hours – I really appreciate this post! Never would have thought to hit the Make a Payment button…

When I figured it out myself, I was like “I got to share this with everyone!”

Super helpful😎

Thank you👍

Very helpful, thank you!

Thank you so very much! Your screenshots were extremely helpful.

Good morning,

I have not received my 1095 A , is it possible to email me the form?

This site isn’t an official government site. I just set this up as a community service. I have nothing

to do with Healthcare.gov or the Health Connector and cannot send you your 1095-A

You’re still helping people! I just used your tips to locate my 1095-A for 2019. Got the IRS Letter 12C today, and have been trying to remember if I ever received the 1095-A or not… first year dealing with APTC… what a headache. Thank you!

Good morning,

I have not received my 1095 A , is it possible to email me the form?

This is a private website sponsored by a friendly website. I have no connection with the Health Connector and

cannot send out a Form 1095-A. You must set up your Health Connector account and follow the instructions on this site.

Thank you for this! It is so clear. Without this, I would have never found the form!

Thank you so much, big help!

Also for those who’s “make a payment” buttons don’t work, don’t use Safari!

I received the IRS letter 12-C. Without your tutorial, I would never have found this form. Thank you!

I was actually in the process of filing an amended return (for a different reason) when I got the 12-C, which says NOT to file an amended return. This was the first year I used a CPA and I wish I hadn’t!!!

Thoughts about filing an amended 1040 after being told not to?

Thanks again for the directions!

Filing an amended return won’t mess things up. It will very much slow things down though. It will take FOREVER for the IRS to figure this out.

For the record however, the CPA is not responsible for the fact that he or she was not provided with Form 1095-A. (If you didn’t give it to him.)

Wow!! That was super helpful. There’s no way I would have found this on my own!

You’re welcome.

Thank you!

Thank you, Charles! You saved my day.

I had got my 1095-A in the mail in its BLUE envelope. I was looking for help in getting Turbo Tax to read the PDF I downloaded from MA Health Connector’s website. I even created a single page PDF of just the 1 page form and it didn’t work.

TurboTax won’t read the PDF, the numbers need to be typed in manually.

Thank you for your help!!

You’re amazing.

You saved me much stress. Last year I got one in the mail and I was freaking out that it hadn’t arrived.

Great to hear it.

Charles

AWESOME!!!! Thank you so much for this really easy to follow instruction. Needed it and wasn’t sure WHERE I’d locate it!

I’m glad this was helpful.

Charles

Thanks!!!!

Very Helpful, thank you.

THANK YOU !!

THANK YOU! I haven’t gotten a 1095-A in the mail yet and am eager to file. This worked ike a charm.

Glad it worked!