ONLINE NEWSLETTER FROM 2017–ARCHIVE

Dear Client:

First off, to new clients receiving this for the first time, welcome to the club! Enclosed you will find your “organizer”, which I am sure some of you will find shockingly thick. But for others, once you work through it, it will prove to be a god send.

This piece is my annual client newsletter. I am surprised how many clients tell me they actually read it! The format has evolved over the years with this year being no exception, as the evolution continues.

This year’s newsletter is noticeably longer, and I made extensive use of graphics which really won’t come to life on the print version you have. However, this issue is also going to have a place online with links. It can be read at www.markhamandcompany.com/newsletter. If you visit this page on my website, not only will you find a somewhat longer version of this newsletter, but there will be an option to ask questions, make comments, and subscribe for updates. Throughout the year, I plan to occasionally update this page as there are 2017 tax law changes that I find interesting enough to share with my clients.

So, what’s up with me?

But first things first. I have a number of my own family events that I wanted to share– mostly because they impact my tax season and early summer schedule. We will soon have two newly minted graduates that my family is unleashing into the world this year. One son is graduating from high school and looks forward to deciding which one to attend. (Don’t people understand that everything else in the world should come to an absolute halt during tax season?) Apparently not. This has reduced the number of available appointment slots this tax season.

My other son is graduating from college in May. Both graduations, (as well as my 25th wedding anniversary, (that’s the upgrade-all-consumer-electronics-in-the-house- anniversary, isn’t it?) are right after the tax deadline, so anyone that is placed on extension won’t be looked at until mid-summer at the earliest.

Moving on to the world of taxes. Well, not quite yet…

IDENTITY THEFT–IT’S HERE, IT’S RAMPANT, AND IT’S GOING TO CHANGE SOME THINGS STARTING IMMEDIATELY! HERE’S WHY…

These days, one can’t start with a discussion of tax law without a discussion of identity theft. Although 95% of you have not been touched, about 5% of my clients at this point have had their tax accounts already flagged by the IRS for ID theft (either as an IRS’ initiative or at the client’s request). Everyone should purchase a credit monitor/identity guard plan. In addition, I recommend a password protection program such as “LastPass”.

Question: What do I and the Democratic National Committee have in common?

Answer: We are both the beneficiaries of extreme Russian attention to our websites.

(But luckily they don’t care about my emails…)

No one has hacked my emails–Well, they haven’t been posted on wiki leaks.

You may recall that the IRS managed to have their website hacked by the Russians and released a number of names, SSN’s, etc of taxpayers who had their identities stolen.

Source: UPI

Over the summer, the IRS finally gets its act together and supposedly gets its systems

secure and under control and then it tells the tax preparer community:

The IRS was saying in all of its summer seminars: “Hey, you tax preparers, we got our systems under control, so you know what? The bad guys, are now going to go after the next “lowest hanging fruit”—that’s you tax professionals!”

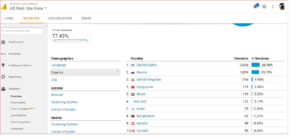

So, don’t take my word for this. When you have a website, there’s this thing called “Google Analytics”. Let’s take a look at where the site traffic for Markham & Company LLC is coming from:

So, in case you can’t read this. While the United States is 38.98% of the visitors to my website, the Russians are 35.78%, and Kyrgyzstan is another 3% and Bangladesh is 1%. That’s right, most of the people visiting my site are basically up to no good.

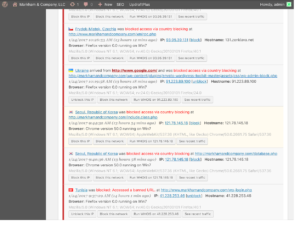

On a daily basis, I can also “look under the hood” and see the various people trying to hack into my website:

Let’s see…Czechia, Ukraine, South Korea, Tunisia….These are my visitors in less than one hour!

Now, everyone, don’t worry, first off, there’s no client data on my website, but it does mean that some things are going to change around here:

- I am going to be adopting a “no click” policy in general for information. This means that, in general, I will no longer accept tax information sent to me as pdf files and in particular ZIP files. Honestly, guys, it is just no longer safe to send information over the internet and I will not be responsible for information so sent. (Yes, there will be some exceptions to this such as when you have one outstanding document that you wish to send me via internet, but you’re taking the risk here.) I would strongly prefer things to be mailed, faxed, phoned in, Fedexed or hand delivered. I don’t want your sensitive data landing in my inbox. I know that this means I will be losing millennial clients who don’t seem to know what a post office is.

- We are going to stop using “portals”. The problem with “portals” where everyone can just upload documents is that they are getting hacked, too. My insurance carrier who underwrites my data compromise coverage (Yes, I have to have that, too, now) will not certify any portal at this time. They think that all of them are vulnerable. On the spy shows the only thing that’s safe is an “air gapped” computer. This is a computer that’s

not connected to the internet in any way. We do “air gapped” tax prep–which means give us your information on paper. Yes, it’s a big step backwards. But if this political year has taught us anything, there is nothing safe on the internet and while you may not be particularly concerned about your information, I am!

- Drivers License information is being input into your tax returns when you e-file. For three states that I know of so far: NY, Ohio and Alabama, your driver’s license number is mandatory when you e-file or the return is rejected. For other states (including Massachusetts) your drivers license is being requested and it will speed up the processing of your return. IT IS PARTICULARLY IMPORTANT TO ENTER YOUR DRIVERS LICENSE INFO IF YOU CHANGE YOUR ADDRESS.

I am therefore asking for your driver’s license number starting this year. I don’t need a copy of your license. You just need to fill in the information the form that is provided.

It is not mandatory, but we are going in that direction. I am asking in the organizer for your drivers license information (ID number, expiration date etc.) I don’t need a copy of it. This information is included in what is sent to the state. It should speed up the processing of your refund. This is the trend and the direction things are going on.

- The IRS is delaying most refunds this year until February 27th. One of the ways to fight Identity Theft is to simply SLOW DOWN on the issuance of refunds. In fact, Congress passed a law that essentially doesn’t allow the IRS to issue refunds until Feburary 15th. The IRS has taken this to heart and has announced it doesn’t plan to issue refunds before February 27th. Many states are following suit. The delay allows everyone to take their time and really scrutinize the data and make sure the returns are correct. Once again, entering your drivers license info will speed up the process.

All of the above may make you wonder, “Well, should I still e-file at all?” E-filing itself is an encrypted process with a specific, proprietary file format being transmitted between two computers. The file doesn’t remain online anywhere once transmitted. There’s a huge difference.

Tax changes for 2017

Let me make one overall comment that I make almost every year when I write this update. For about the last few years there has not been anything terribly much new. This year is really not an exception. What happens each year, is that there are a bunch of expiring tax provisions and invariably Congress would always extend them. Some of them are extended for one year, some for two years and some they even make permanent. Many tax newsletters proudly tell customers about all the “changes” but the “changes” are simply telling them what was made permanent, what was extended, what was extended for two years, etc. I find this terribly boring.

Here’s my rule: If nothing changes–except its expiration date, I am not talking about it.

Honestly, I really do expect some pretty interesting changes in the tax code this coming year, and hopefully, just for my sanity, they will happen early or midway in the year when we can digest them rather than in November. So, that’s why I am for the first time setting up an online email list for a very short newsletter of my tax updates with no promises as to frequency! I hate spam as much as you do. So you may go to my newsletter webpage and sign up (or there’s a box in the organizer to sign up) or finally I think if you “like” my brand new, shiny Facebook page I might post something there. No promises, I am way too busy to be buried churning out social media, but there may be enough going on that it is worth commenting on.

Okay, so finally, let’s dig into what few, relevant tax changes there were for 2016….

Due date changes for 2017

This year, the tax deadline will be Tuesday, April 18th. This is due to “Emancipation Day” in Washington DC, but it happens to correspond with Patriot’s Day here in Massachusetts.

Partnership returns are now due March 15th instead of April 15th. The idea is to get K-1’s in the hands of taxpayers sooner, but honestly, this will likely result in more partnership returns getting put on extension, at least in this office.

C Corporations which used to be due March 15th, are now due April 18th. (S Corporations are still March 15th–because they have K-1s).

FBAR reporting form (Fin Cen 114) (Foreign Bank Accounts) For those handful of clients that have more than $10,000 in a foreign bank, or stock, or brokerage accounts, this form is now due April 15th and can be put on extension until October 15th. The June 30th deadline is gone and is no longer relevant.

1099’s and W-2’s

If you have employees and contractors, you previously had until February 28th or even March 31st to file these reports with the IRS. Now, you must file them with the IRS by January 31st. I want to emphasize how important it is that if you pay contractors more than $600 and are subject to the 1099 filing requirement, you should file at least one 1099 with the IRS. This is a result of many examinations I have been involved with. The IRS has a report of whether or not you filed 1099’s in the past and the fact that you didn’t file any at all can look very bad for you if you appear subject to the reporting requirement. There is a 30-day automatic extension to file 1099’s that can be obtained if you request it by January 31st.

“Close enough for government work”

While we are on the topic of W-2s and 1099s, the IRS has now changed the rules. If anyone issues a W-2 or a 1099 and later finds that the amount is incorrect by $100 or less in the dollars reported or $25 or less in withholding, they do not have to issue a correction. In many previous years, a client would get a “corrected 1099” from a brokerage firm for a small amount after we filed their taxes and call me in March and ask what to do–now you won’t get a corrected 1099 at all. Note that this applies when you are the person issuing the 1099s and W2s, too.

Education Related Changes

There have been a few changes that affect higher education:

FASFA Changes starting in 2017. Any parent with a kid in college knows that “FASFA” is the form that you file online for financial aid. It used to be that these

forms were due in early February which required a parent to rush to complete their taxes, stressing everyone out (including yours truly). Effective 2017, parents no longer use their 2016 taxes but instead use the prior year (2015) for financial aid. Essentially, this means that you will use four years to base your financial aid on, just a different four years. Of course, you will probably still need to send in a scan of your 2015 taxes and remember that they will also want your W2’s.

Form 1098-T is now mandatory to claim the American Opportunity Tax Credit.

No Form 1098-T, no tax credit.

Effective in 2017, Massachusetts is now giving a state tax deduction for contributions to the Massachusetts U. Fund and the U. Plan, however it is only for the first $1,000 on a single return and $2,000 on a married return.

Health Related Changes

HSA’s make great IRA’s. Many more people are covered at work by Health Savings Accounts (HSAs). If you are covered by an HSA, you strongly want to consider maxing out on your HSA (if you aren’t already) and think of this purely as a retirement option. This is because, there is no income limit on contributing to an HSA. When you hit 65, HSAs can be used to pay for Medicare as well as other medical expenses and nearly everyone is going to have Medicare premiums. This means that you will be able to withdraw from your HSA on a tax free basis. So, an HSA becomes the following: a tax deduction now and a tax free withdrawal when you are 65, and nobody says you have to spend the money when you withdraw at age 65, you can just withdraw it and invest it, give it to your grand kids or whatever.

In addition, everyone has the once in a lifetime option of rolling over one IRA into an HSA (up to the annual dollar amount). You would do this because, like I said, an HSA is really a “Super IRA”. Talk to me and I can explain this is in more detail. Obamacare for 2016. While supposedly Obamacare may be a thing of the past, it was on the books for 2016 and is still here for the time being. If you didn’t have health insurance for all of 2016, the penalties for not having health insurance increased in 2016. However, there is an executive order instructing the IRS to try to minimize penalties wherever possible. If you owe penalties, we will try to explore every option because I expect a very favorable environment for getting penalties waived.

CURE Act. On December 13, 2016, a new piece of legislation was signed that allows small businesses (less than 50 employees) to offer a new type of health coverage plan for its employees. This new option allows an employer WHO DOESN’T OFFER HEALTH INSURANCE FOR THEIR EMPLOYEES to offer a new reimbursement plan where the employer agrees to reimburse each employee a fixed amount toward employee’s health insurance or their out of pocket medical expenses. This allows employers who have wanted to contribute to their employees health insurance but needed to cap their exposure to set limits. Their employees would then buy their own health insurance using the health connector.

None of the Above.

IRS has liberalized the 60 day roll over rule. Many of you may be familiar with the rule that says you have 60 days to take money from one IRA or retirement plan and roll the money into another plan. The IRS has the authority to waive the 60 days (grant you more time in certain limited situations). But in order to get this extension was a very complicated and expensive process. The IRS has now issued something called “safe harbor Revenue Procedure 2016-47”. This basically gives a taxpayer an additional 30 days (for a total of 90 days) to roll the money over assuming that one of 11 very common situations happen. The taxpayer can fill out a form and “self-certify” to get this extension of time automatically.

Increased due diligence. The IRS has increased the level of questions that a preparer must ask for clients receiving the Child Tax Credit, the Earned Income Credit (EIC) and the American Opportunity Education Credit. If you received these credits, be prepared for me to ask you questions you will think I already know the answers to.

In particular, if you have children, there’s a very important new question in the organizer that I will need you to affirmatively answer “yes” in writing to that you can provide documentation to substantiate your eligibility to claim the claim any of the following credits: Earned Income Credit, Child Tax Credit, American Opportunity Credit. This is a new IRS requirement.

And finally…

File this final one in the category of “Well, you never know the next time you might be looking to make small talk at a party”:

Payments for wrongful incarceration are now tax free. If you know or run into anyone who was wrongfully put in jail and has been released through DNA or other exculpatory evidence, whatever compensation they might receive, is now 100% tax free.

Thank Congress for little favors.

I don’t know about you, but 2016 really wore me out–especially towards the end. All I can say is keep your seat belts fastened for the rest of 2017!

As always, I look forward to preparing your taxes!

Charles Markham, MST, EA, USTCP

HAVE A QUESTION OR A COMMENT ABOUT A TAX LAW CHANGE? LEAVE IT BELOW AND I WILL RESPOND.

(781)

659-6600

(781)

659-6600